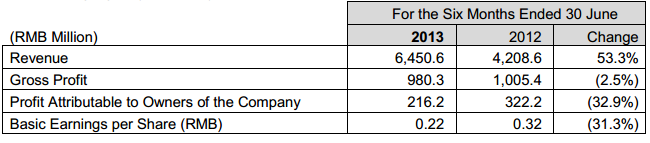

Revenue of Chaowei Power Increases by 53.3% to RMB 6.45 Billion in 1H2013

Further Expands Market Share amid Industry Consolidation to Enhance Future Profitability

Financial Highlights (Unaudited)

(Hong Kong, 27 August 2013) Chaowei Power Holdings Limited (“Chaowei Power” or the “Group,” stock code: 0951), a leading electric bike motive battery manufacturer in China, today announced its unaudited interim results for the six months ended 30 June 2013.

Benefiting from strengthened industry consolidation policies as well as strong market demand, the Group’s sales volume of lead-acid motive batteries increased during the period under review, boosting the revenue to increase by 53.3% to RMB 6.45 billion. Gross profit of the Group decreased by 2.5% as compared to the same period in 2012 to RMB 980 million. Profit attributable to the owners of the Company decreased by 32.9% to RMB 216 million, which was mainly due to the strict enforcement of industry regulations, resulting in closure or suspension of production of numerous sub-standard enterprises. In order to gain market share from enterprises eliminated by the “Entry Requirements of the Lead-acid Battery Industry” (“Entry Requirements”), major lead-acid motive battery producers have already started to offer higher rebates starting in the fourth quarter last year. The Group also strategically carried out short-term price adjustments which led to a decrease in the average selling price of its products during the period under review. Nevertheless, the Group has therefore further consolidated its market-leading position and enhanced its future profitability through gaining market share while smaller-scale and sub-standard operators were weeded out. The Group considers that it is able to adjust prices on products in response to market environment and it is confident of maintaining a healthy gross profit level.

Business and industry review

The Entry Requirements jointly promulgated by the Ministry of Industry and Information (“MIIT”) and the Ministry of Environmental Protection (“MEP”) strictly stated that the existing production capacities of lead-acid batteries and the related lead-based components with cadmium content above 0.002% or arsenic content above 0.1% shall eliminated by 31 December 2013. The Group actually began to develop the Enclosed Battery Formation Process as early as 2004. By 2009, the Group comprehensively mastered the core technology involved. In recent years, the utilization of the Enclosed Battery Formation Process of the Group’s production capacity increased significantly, which were approximately 57% and approximately 83% in 2011 and 2012 respectively. As at 30 June 2013, such technology has been adopted in over 80% of the production capacity, making the Group one of the few manufacturers in the PRC to have successfully adopted this process in large scale production.

The PRC government is determined to strictly enforce the existing industry requirements and regulations and carry out specialized inspections. A list of enterprises which have passed the inspections will be released to the public from time to time. On 16 April 2013, MEP released its first list of 10 lead-acid battery and recycled lead production enterprises which comply with the requirements of the environmental laws and regulations. Henan Chaowei Power Co., Ltd. and Jiangxi Xinwei Power Technology Co., Ltd., subsidiaries of the Group, were included on such list. On 17 July 2013, MEP issued an announcement on the second batch of 27 lead-acid battery and recycled lead production enterprises meeting the environmental protection laws and regulations, which included Shandong Chaowei Power Co., Ltd., Ciyao Branch of Shandong Chaowei, Jiangsu Chaowei Power Co., Ltd. and Jiangsu Yongda Power Co., Ltd. Other subsidiaries of the Group have also actively cooperated with relevant departments to carry out inspections on environmental protection within their operations. On 31 July 2013, MEP also announced the investigation result of the major environmental pollution issues in the second quarter this year, which listed 34 incidents involving several manufacturing industries including battery production, in which none of the Group’s production facilities were cited.

After several rounds of large-scale consolidation, the number of lead-acid battery enterprises in China decreased significantly starting from 2011. It is estimated that by the end of 2013, the number of qualified lead-acid battery enterprises will further decrease.

During the period, the Group has achieved steady development in respect of capacity enhancement, sales network expansion and strengthening of research and development capabilities.

Capacity Enhancement

The Group proactively embarked on further expanding its production capacity through upgrading the existing production facilities and setting up new production facilities to meet market demand. In April 2013, the Group’s first manufacturing facility in Hebei Province commenced production as scheduled. In June 2013, the Group entered into an investment framework agreement with the committee of Jiangsu Binhai Economic Development Zone for the proposed investment and construction of new production facilities in the Jiangsu Binhai Economic Development Zone. As at 30 June 2013, the annual production capacity of lead-acid motive battery surged from 90 million units as at the end of last year to 100 million units, representing an increase by over 11%.

Sales Network Expansion

The Group continued to maintain a good relationship with major Chinese electric bike manufacturers, through which it has provided the original batteries for their electric bikes. During the period under review, sales in the primary market was RMB1,692,678,000. The Group also further strengthened its distribution network in the secondary market. Leveraging its quality products and good service, the Group has solidified the loyalty of its customers and boosted sales growth in the secondary market. As at 30 June 2013, the total number of independent distributors increased from 1,179 in the end of 2012 to 1,383. During the period under review, sales in the secondary market amounted to RMB4,389,057,000, with a year-on-year increase of 93.6%.

Strengthening Research and Development Capabilities

During the period under review, the Group’s various research and development projects on lead-acid motive batteries, lead-acid storage batteries and lithium-ion batteries have achieved considerable progress, with a number of products tested and evaluated and subsequently commencing production. With respect to product upgrades, the Group has adopted a threefold approach including independent, collaborative, and cross-border research and development. Meanwhile, the Group exerted greater efforts in talent recruitment. As at 30 June 2013, the Group has already recruited more than 20 technical professionals in the electrochemistry and the motive battery industries from China and overseas. These professionals are responsible for conducting regular training for the Group’s technical staffs or providing on-site consultancy for their R&D work, which has significantly strengthened the Group’s integrated R&D capability. Currently, the Group has developed a new generation of products, which feature larger size and greater volume, stronger electricity charging and discharging capabilities, better functioning at low temperatures, and longer life expectancy. As at 30 June 2013, the Group has a total of 368 patents, including 31 invention patents.

Future Developments

As the requirements on cadmium-free production of the Entry Requirements have entered the final enforcement stage, the consolidation of the lead-acid battery industry will further advance and more sub-standard manufacturers will be affected. While posing challenges for the industry, consolidation will provide a very favourable development environment for the Group.

In order to capture the market share released by those eliminated sub-standard production capacities, the Group will continue to expand its production capacity through upgrading the existing production lines, building new production facilities and carrying out strategic acquisitions. It will continue to implement effective sales network extension strategies, which include: executing a multi-brand and multi-channel strategy to extend the coverage and penetration of the sales network as well as to raise pricing power; streamlining the traditional three-level channel structure to a two-level channel structure to shorten the product delivery time to users; providing training to help enhance the management capability of the independent distributors and the communication and cooperation between the Group and the independent distributors.

The Group is confident that through continuously deepening the cooperation, Chaowei Power and its independent distributors will jointly secure higher profit and greater scope for development against a backdrop of increasing market competition.