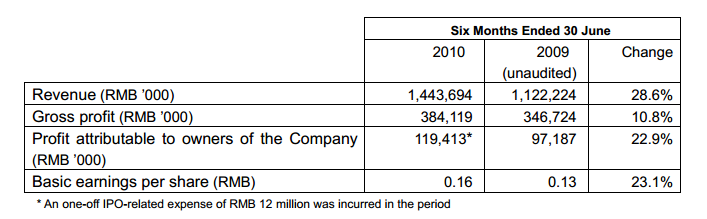

Chaowei Power 2010 Interim Revenue Up 28.6% to about RMB1.44 Billion

Net Profit Up approximately 22.9% to about RMB119.4 Million Seizes Market Opportunities to Achieve Significant Business Growth and Enhance Product R&D to Drive Industry Development

Hong Kong, 26 August 2010 – HK Chaowei Power Holdings Limited (“Chaowei Power” or the “Group”; stock code: 951), a leading electric bike motive battery manufacturer in China, today announced its interim results for the six months ended 30 June 2010 (“the “reporting period”). The Group reported significant growth in revenue and net profit as it seized the opportunities arising from the fast growth of the domestic lead-acid motive battery industry through active business promotion, timely expansion of capacity, improvement in efficiency and enhancement of internal management. The net profit achieved is about 5.7% higher than the Group’s project forecast of RMB113 million listed in its IPO prospectus in June 2010.

The Group’s revenue amounted to approximately RMB1.44 billion, an increase of 28.6% against the same period last year, primarily attributable to growth of sales volume of lead-acid motive batteries and a rise in the average unit price of batteries. The Group sold 15.2 million batteries within the review period (the same period in 2009:12.1 million batteries). Gross profit rose to around RMB384 million. However, as the price of lead was higher than in 2009, gross profit margin dropped 4.3 percentage points from 30.9% to 26.6%. Profit attributable to equity holders increased to approximately RMB119 million and basic earnings per share were RMB0.16.

Mr Zhou Mingming, Chairman and Executive Director of the Group, said, “We are very pleased to see Chaowei Power achieve strong performance in its first results after listing. This is not only the best reward to our shareholders, but also a testimony of our capability. The cumulative market size