Chaowei Power Announces 2011 Interim Results

Rising Demand and Accelerated Industry Consolidation Drive Business Growth

(Hong Kong, 23 August 2011) Chaowei Power Holdings Limited (“Chaowei Power” or the “Group”, stock code: 951), a leading electric bike motive battery manufacturer in China, announced its unaudited interim results for the six months ended 30 June 2011.

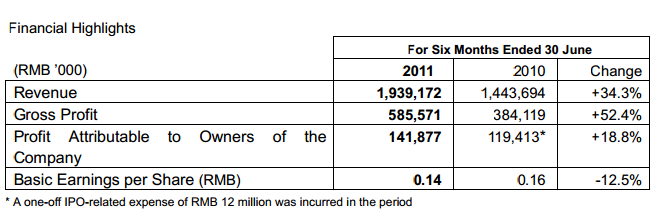

The Group’s revenue for the period under review amounted to RMB1,939,172,000, representing an increase of 34.3% compared to RMB1,443,694,000 for the same period in 2010. The increase was primarily attributable to the growth of sales volume of lead-acid motive batteries and an increase in the average selling price per unit of battery. The gross profit for the period amounted to RMB585,571,000, representing an increase of 52.4%. Gross profit margin increased from 26.6% to 30.2% primarily because of the increase in average selling price of the products. The profit attributable to the owners of the Company rose by 18.8% to RMB141.9 million, and the basic earnings per share was RMB 0.14, decreased by 12.5% from last year’s because the number of shares issued upon listing was excluded from last year’s calculation.

Driven by the favorable business environment, the Group’s sales in the first half of 2011 increased by 34.3%. Though there was slight increase in lead price, the Group managed to raise the average selling price of products by 13%, keeping the Group’s gross profit margin at a healthy level. Chaowei Power Announces 2011 Interim Results 23 August 2011 Page 2

In view of the ever growing market demand for electric bikes and the shortage supply of lead-acid motive batteries because of industry consolidation after the government further tightened regulatory measures in the first half of the year, the Group has endeavored to continuously enhance the production capacity. During the review period, the Group’s new production facilities in Henan Province and Anhui Province were in full operation. The construction of a new production facility in Ningyang County approved by the Broad last October has proceeded smoothly and will commence production in the third quarter of 2011. The Group’s new wholly-owned subsidiary, Jiangxi Xinwei Power Technology Co., Ltd., entered into an agreement with the Shanggao County government to construct a new production facility, and the first phase is scheduled to commence production in September 2011 and expected to be put in full operation in first half of 2012. Moreover, the Group completed the acquisition of Anhui Yongheng Power Technology Co., Ltd. in June 2011. It is expected that the annual production capacity of Anhui Yongheng will increase gradually from the existing approximately 1 million units of lead-acid motive batteries to approximately 9 million units of lead-acid batteries. The Group considers this acquisition as a more cost effective and time efficient way to expand the production base in Anhui province. In addition, Shandong Chaowei has resumed its productions since May 2011, and the Group looks forward to restoring its production volume to approximately 6 million units in 2011.

In recent years, the PRC’s environmental authorities have strengthened their inspection of lead-acid battery manufacturers and strictly monitored against any non-compliance of enterprises. Chaowei Power has adopted cutting-edge production technology and environment friendly production methods in order to maintain its product quality and to minimize the impact of battery production on the environment. As a leading enterprise in the lead-acid battery industry, the Group has benefited fully from the recent industry consolidation.

There is a growing concern over pollution prevention efforts of lead-acid battery and the government is stepping up its efforts in industry monitoring. A list setting out lead-acid storage battery manufacturers that were ordered to shut down due to substandard product quality was released on 2 August 2011. Among 1,930 lead-acid battery manufacturers, 30% were ordered to close down and 53% were required to temporarily suspend production. Only approximately 13% were allowed to maintain their production. As a result, the production capacity of the lead-acid batteries industry has been reduced significantly starting from the second quarter of 2011. In light of the sustaining strong market demand, the increasing lead-acid battery shortage would drive up the selling price. In the long run, well-established lead-acid battery manufacturers as Chaowei Power will benefit from it while enjoying favorable business opportunities arising from market excess demand and industry consolidation. The Group will strive to bring large and sustainable returns to the shareholders.